Looking to Improve Your Revenue Cycle Management?

The growing challenge of rising provider costs, a volatile healthcare market, and patient debt may seem insurmountable, but that is precisely why revenue cycle management is so important. Revenue cycle management is dynamically evolving under a growing value-based approach to care as well in an age of digital innovation, and providers, from single-doctor family practices to large hospital systems, are quickly having to learn to adapt.

How Does Value-Based Care Affect Revenue Cycle Management?

As the healthcare industry shifts in part to a more value-based approach to care versus a fee-based, revenue cycle management is remolding itself again. What does this mean for providers?

When it comes to value-based reimbursements, the incentive for healthcare providers to do away with redundant tests, overprescribing, and excessive and unnecessary procedures are aimed at improving the quality of care for patients while reducing costs. Providers will only get paid out on the care provided depending on how it fits into a new value-based matrix of care quality and patient outcomes, not on the number of tests administered or how long a patient stayed under your care for example.

The Centers for Medicare and Medicaid Services details seven value-based programs including ones for hospitals, solo physicians and other clinicians, nursing home facilities, and home health agencies. A good example of how value-based care is measured is in the Hospital-Acquired Condition (HAC) Reduction Program which differentiates payouts to hospitals based on their ability to reduce the number of hospital-acquired conditions like pressure ulcers, urinary tract infections, and surgical site infections.

Value-based reimbursement models originally came out of the Affordable Care Act and are expected to surpass fee-for-service payments in the next three years according to recent survey data, especially as more and more commercial insurance institutions and large health systems innovate their transitional solutions. This shift doesn’t circumvent revenue cycle management but rather requires greater efficiency, more effective workflows, and clearer patient/doctor collaboration.

Common Hurdles in Revenue Cycle Management

Tackling the obstacles that impede successful revenue cycles isn’t possible without first pinpointing all the common inefficiencies which create those obstacles in the first place.

- Backed Up Workflow Is a lack of staff training and registration process backing up the workflow in your office? Not adhering to a strict order of steps at patient intake, i.e., copying ID and insurance cards, verifying up to date contact information, etc. can lead to mistakes with billing and claims filings which back up your workflow and negatively impact your team’s performance. Basic checklists at the registration desk can make a significant difference in keeping your team on track and organized, and giving patients a reliable sense of service and organization.

- Bill and Collection Errors Even the slightest errors like name misspellings, patient ineligibility, coding errors, and incomplete plan information can lead to claims denials and missed communication which back up the return on your revenue cycle. Scrubbing claims with a strategic claims oversight process may involve extra staff time and cost, however, taking a few extra minutes to catch mistakes from the start can prevent days or even weeks of delay in payment on the back end.

- Post-service Expenses The less your office does before a patient’s appointment, the bigger the pile of post-service expenses grows. Post-service expenses may include filing with insurance, invoicing the patient, following up regarding an outstanding bill, taking payment, writing off bad debt, and scheduling new appointments. Not only does this lengthen the time between seeing a patient and getting paid for the care provided, but it can negatively impact the provider/patient relationship when post-service communications and billing get confused and messy.

- Lack of Digital Solutions Is your office’s website setup to accept online payments? Do patients have multiple ways to settle a bill at their appointment (i.e., cash, credit, debit, check)? Can patients print important forms off of your website to have ready for their appointment? In this day in age, patients are expecting technological solutions for everyday tasks, and if your office is behind the times, it will show. A lack of digital solutions stagnates the revenue cycle, impairs patient/provider communication, and reflects poorly on your office.

- Nondescript Financial Policies Want to make it extra clear how billing is processed and when payment is required? If your organization is lacking a detailed financial policy, your employees (and patients) may not have the guidance they need to keep filing, invoicing, and payments on time and secure. Financial policies paint a clear picture of the billing process including how and when patient responsibility for outstanding balances is determined, what happens when claims are denied, how to communicate insurance requirements and copayments, and so forth.

Smart Tips for Improving Revenue Cycle Management

Improving revenue cycle management might seem like a lofty, costly and time-consuming goal. However, it’s “the little things” which can add up to the biggest impact. Smart tips for improving Revenue Cycle Management include:

1. Enhance Pre-Admission Contact

Want to boost cash flow fast? Going the extra mile before a patient’s admission may do just that. Make contact before an appointment or elective procedure with a simple phone call or email directing patients to printable forms they need to fill out, confirming how and when payment is processed and explaining what to expect at the appointment/procedure, for example.

Connecting before admission also speeds up registration time the day of admission, and allows patients to ask any questions or voice any concerns they may have. This, in turn, establishes a strong and friendly foundation from which patient loyalty will grow. Your team in charge of intake and registration should feel inclined to achieve as much as possible in this beneficial window before patient arrival, even going so far as to verify contact information (including email address) and even potentially to take payment over the phone.

Your front-line staff who handle pre-admission communication and registration workflows are a key point of contact for understanding where roadblocks in process lie. Regularly survey and conduct dialogues with this staff, especially as data insights reveal trending mistakes or tasks which take up too much time. You may be surprised to learn that simple office upgrades like standing desks, new headsets, or back support for office staff chairs can make a big difference in the front-line experience and team performance. For more info on back supports, click here.

2. Use Software Solutions to Streamline RCM

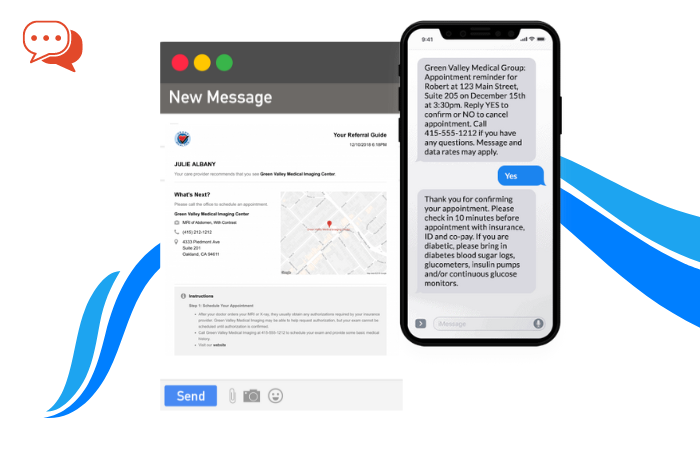

Digital solutions by way of revenue cycle management software and online patient portals is a must for streamlining patient communication and payments. Cloud-based RCM software offers medical providers the unique ability to aggregate claims filing, invoicing and payment transactions, appointment scheduling as well patient data (among other things) all in one single convenient place.

Insights into patient trends, i.e., rates of visits, occurrences of chronic illness, payment rates, etc., can help your organization make data-based decisions when it comes to updating technologies and services. And housing all accounts receivable information in one central place can make the patient intake, billing, and payment processes more efficient.

Patient portals like Phreesia which allow patients to check-in or reschedule appointments, access health records, resolve outstanding balanced, request refills, and message doctors also empower patients to take a larger role in their health and wellness. The value of healthcare comes across not just through the treatment and medicine which helps a patient recover from illness, but in the steps, a medical provider takes to help a patient prioritize transparency and prevent illness. Interactive online tools that give patients more control over their health management reflect well on both the goals of your office as well as your modern embrace of technology.

3. Appoint a Dedicated Care Coordinator

Under a value-based care net, doing more by way of increasing patient volume and ordering more tests and treatments no longer guarantees more payout from insurance companies. Instead, government programs and insurers are looking further past the quantity of a provider’s care to the quality and efficacy of their care.

Understanding the transition in policy by which payouts and reimbursements will be measured by the quality of care as well as the efficiency of the organization will require the involvement of a dedicated care coordinator. A care coordinator can stay up to date on legislation and policy changes, update your organization’s financial policy, and work with providers and patients to optimize care under the new value-based model.

Positive medical outcomes will be the product of stronger patient/provider collaboration, and care coordinators can serve as those liaisons between both parties, helping clinicians better understand patient concerns and health hurdles, and motivating patients to claim a larger role in their treatment and wellbeing.

Care coordinators can also organize health and wellness clinics which exist outside of day to day appointments and procedures, and which do in fact optimize the quality of care patients receive. Billing, coding, and collecting will no longer be the only force by which revenue cycles churn. Care coordinators can play an important role in making sure health systems and providers recognize care quality goals and formulate programs which ensure the highest payouts, and which also boost patient loyalty and health outcomes.

4. Improve the Patient Financial Experience

The coverage landscape has changed so drastically in the past two decades to a point where some healthcare organizations which were once receiving only 10% of all payments from patients (the rest paid out by health insurance companies and the government) now rely on patients to make up over 30% of all payments.

A volatile marketplace combined with fluctuating legislation has driven many patients to buy into high-deductible plans with low premiums. These types of insurance plans are more affordable on a month to month basis for patients, but often leave patients footing the bill for the entirety of all their appointments, prescriptions, or procedures. A report from the Advisory Board found that the higher a patient’s deductible, the less likely they were able to pay for their care at the time of service.

Patient adherence to payment requirements can vary from organization to organization, and often are not met because of reasons including:

- Patient inability to pay the amount required

- Patients did not know they owed money

- The patient does not have needed payment method (i.e., your office requires check or cash, and they only have a credit card)

- Patient disputes the charge

- The patient doesn’t understand the bill

- Patient missed the bill in their mail

- Filing errors sent the bill to wrong place

Providers can take small, manageable steps to improve the rate of patient payment including verifying valid contact and mailing information before admission, offering multiple methods of payment (i.e., credit or debit, payment plans, online portal, etc.), and collecting copayments before treatment.

Providers also need to recognize shifts in patient expectations and act accordingly. For example, an older patient might be used to getting a bill in the mail, while younger adults in their 20s and 30s might rely more on email and text messages for payment and appointment communication.

5. Measure, Measure, Measure

Simply knowing your organization is behind on collecting payments, or is making too many errors when filing claims, isn’t enough. Successful revenue cycle management relies on measuring key rates and statistics and setting regular goals to measure the efficacy of workflow changes and updates to existing protocols.

Collection rates, for example, paint a picture of the percentage of patient payments which are successfully captured during a billing cycle. Medical providers want those rates to be above 85% minimum, and even closer to 95 or 100%. While the hard truth is that some patients will never resolve their balance, it’s critical to learn how many are paying and what steps can be taken to increase that number.

Progressive measuring of key metrics and benchmarks can also highlight recurring discrepancies when it comes to claims filing, denials, and billing. Keener oversight might reveal irregularities in certain payor denials, helping to pinpoint potential issues worthy of contract negotiation.

Other key statistics worth monitoring are how many claims are denied and for what reasons (i.e., typo, coding error, missing information), average number of days it takes patients to settle a bill, and how often patients miss appointments when they are reminded via phone call versus email or text.

Final Considerations

While consistently the topic of political debate, the continued evolution of the healthcare system in America will largely be shaped by the patients themselves and those medical providers who treat them. On the patient side, you have growing rates of obesity, heart disease, diabetes, Alzheimer’s, and other chronic conditions which require ongoing medical care. Combined with an aging populace of Baby Boomers who will all age into Medicare eligibility by 2030, and providers have an explosive reason to optimize on value-based payouts.

How healthcare organizations adapt to both value-based payout models and mounting demand for digital solutions will forge the future of revenue cycle management as the country knows it.