While some doctors might be skeptical about joining an Accountable Care Organization (ACO), others are following in the footsteps of the 19 out of 32 Pioneer ACOs who have seen notable economic success. Why? Because these groups of doctors understand that being part of an ACO isn’t just another fruitless attempt to transform managed care, but rather an intelligent business strategy that includes a few government incentives for coordinated care.

Here are six simple reasons why physicians join ACOs and the incentives they receive.

1. Reduced costs and increased savings

Like any business, it’s important for practices to keep their costs low. ACOs work to achieve this by incentivizing physicians to keep their patients healthy and out of the hospital through prevention and avoidance of unnecessary hospitalizations, emergency room visits, and tests and procedures, aka coordinated care. Unlike traditional fee-for-service payment systems that reward physicians on the number of [unnecessary] procedures administered, ACO fee-for-service systems encourage physicians to be more efficient with the tests they apply by offering bonuses for reduced costs instead. And it seems this model is working.

Interested in an application that can help reduce costs? Check out ReferralMD’s CRM Software specifically designed for healthcare.

In just the first two performance years, provider groups have saved more than $384 million in Medicare spending. According to the Centers for Medicare and Medicaid Savings (CMS), total gross savings amounted to $279.9 million in 2012 and $104.5 million in 2013. While not every Pioneer ACO saw success, however, those that did, received total model savings of over $96 million, and qualified for shared savings payments of $68 million. Additionally, results also showed that the Pioneers slowed cost increases by an average by only 0.3% versus 0.8% for Medicare FFS beneficiaries. These figures demonstrate that, while still in its infancy, ACOs are indeed able to reduce costs while providing greater quality of care.

One such Pioneer, who cut costs and saw notable financial success, was New York City-based Montefiore Medical Center. According to the CMS, Montefiore achieved the highest economic performance among the 32 Pioneer ACOs. By collaborating with physicians in the community, Montefiore was able to reduce costs by 7% and improve care overall according to the quality benchmarks set by the CMS for more than 23,000 patients. However, this was not easily achieved. To receive the $14 million of savings it generated for Medicare, Montefiore had to establish strong partnerships and successfully coordinate care with physicians within their network. “Our success reflects our unique approach to healthcare and our strong partnerships with community physicians and other regional healthcare providers,” said Steven M. Safyer, M.D., president and chief executive officer of Montefiore Medical Center.

Therefore, it should be noted that to reduce costs and increase savings, practices, and physicians should carefully consider which healthcare providers they choose as partners. Otherwise, it could mean sharing losses instead of profits for their business.

How do ACOs help you reduce costs and increase savings?

For an ACO to increase savings, it must reduce costs by limiting unnecessary services, while demonstrating that it has met the 33 nationally-recognized quality care measures, set by the CMS, in four key areas:

- Patient/caregiver experience (7 measures)

- Care coordination/patient safety (6 measures)

- At-risk population (5 measures and two composites)

- Diabetes (1 measure and one composite consisting of 5 measures)

- Hypertension (1 measure)

- Ischemic Vascular Disease (2 measures)

- Heart Failure (1 measure)

- Coronary Artery Disease (1 composite consisting of 2 measures)

- Preventive Care (8 measures)

To successfully report these quality measures, healthcare providers must also use a combination of administrative data (4 measures), a Web Interface (WI) database designed for practice- or ACO-level clinical quality measure reporting (22 measures), and a patient experience of care survey (7 measures).

2. Strategic partnerships with other providers

In its broadest terms, an ACO is a group of providers including hospitals and other health systems that share in savings by working together to meet quality-of-care objectives and reduce costs. However, when goals aren’t reached participants share losses. That’s why it’s crucial for participants to be strategic with their partnerships.

While this may be difficult for independent practices who prefer their autonomy to adopt, it’s actually in their best interest. Yes, sharing accountability that results in profits or losses is seemingly risky. However, forging new partnerships can also help independent practices gain leverage, according to Kip Piper, a healthcare consultant in Washington, D.C.

Piper says adapting from one payment model to another can be a major pain for a lot of providers. They fear not being able to move resources around or make decisions in an autonomous way. However, contrary to popular belief, physicians and practices can make decisions in ways that are unconfined by monocratic payment models like traditional FFS.

Moreover, partnering with other healthcare providers also means the opportunity to improve further the patient’s experience by collaborating more closely to share and refine existing tools and resources. In turn, that means greater value for customers through improved health outcomes and decreased pressure on health insurance premiums, giving physicians more control over their patients’ care, and enabling increased profits.

Participating in an ACO isn’t just about improving care, however. It’s also a smart business strategy (as mentioned earlier) because it allows healthcare providers to extend (and maintain) their networks. According to the 2012 Medscape Business of Medicine report, 8% of physicians were part of an ACO or planned to join an ACO within a year. However, in 2013, 24% of participants in the study were either in an ACO or considered joining one by 2014. These figures demonstrate that popularity in joining an ACO is growing. That means if nearby practices join an ACO, and other practices do not, they could be left out of that referral network, thereby losing patients and revenue. (see also “State of ACO’s and Ethical Rferral Use“)

How do ACOs help you develop strategic partnerships?

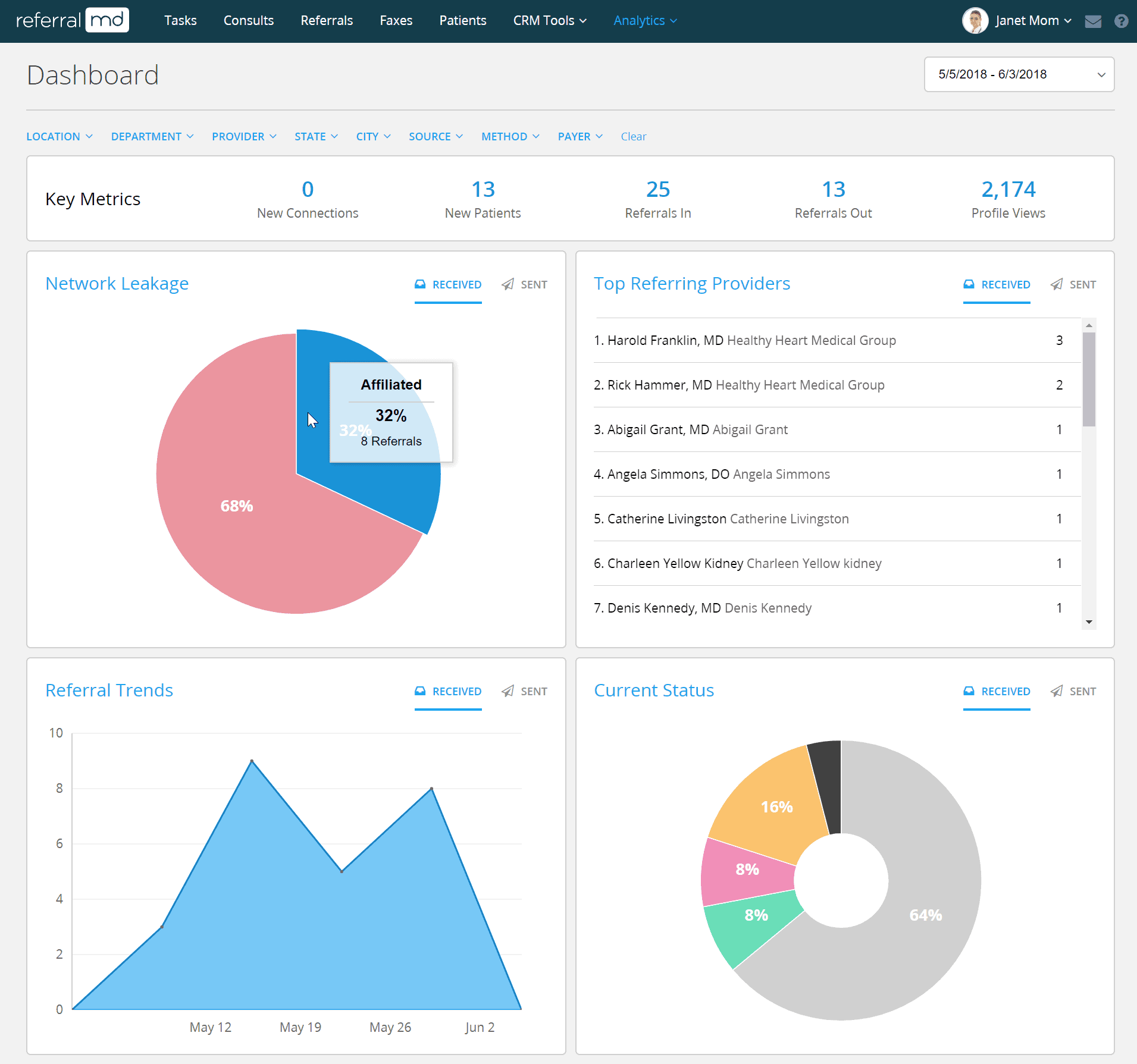

Because savings (or losses) are shared among the physicians, hospitals, practices, and other healthcare systems within the formed ACO, it’s crucial for providers to be strategic about their partnerships. ACO participation requires you to improve care coordination across all ACO partners, increase patient engagement, and use technology, such as a referral management system to better track patient care.

For small or independent practices, this could be a major “leg up” on the competition by getting access to technology that they may not have otherwise had. Technology, like a referral management system, for example, lets physicians not only better track patient care but also reduce referral “leakage” and expand the ACOs provider network.

3. Greater reach within provider networks

The healthcare landscape is evolving. ACOs are launching all over the country by non-hospital organizations, such as large medical groups, and with this shift towards new payment models, organizations realize reasons to join. To date, over 428 ACOs exist in 49 states, more than double the number at the start of 2011.

According to a survey by the Healthcare Information Network survey, 70% of healthcare organizations participate in CMS’s Medicare Shared Savings Program (MSSP). Nearly 10% take part in the Advance Payment ACO, a federal payment model more suited for small physician practices and doctors in rural areas. Also, 25% of respondents will launch a new ACO in the next 12 months.

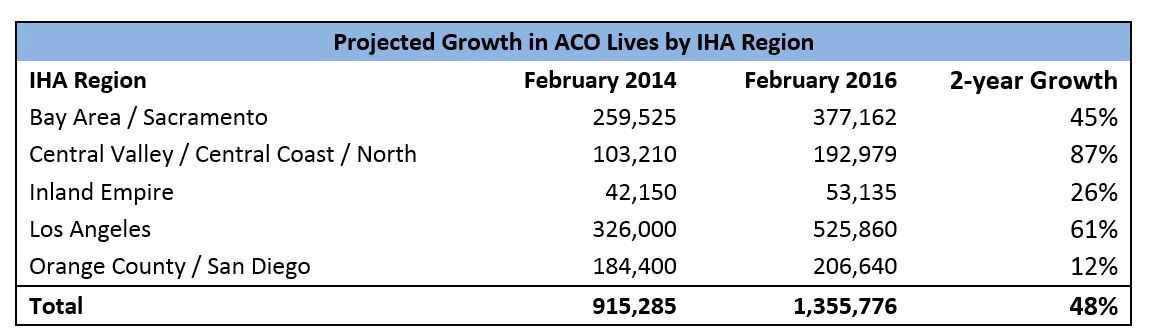

California, for example, has over 67 ACOs, more than any other state, and by 2022 estimates to have 60% of the state receiving integrated care. A Berkeley Healthcare Forum Report also estimates more than 1.3 million Californians will receive care from ACOs within the next 12 months, with increased growth in nearly all regions of the state (see below table).

(Image Source: Health Affairs Blog)

What this means for healthcare organizations not already in an ACO is they’ll have the opportunity for greater reach within provider networks by partnering with providers who were previously out-of-network. In other words, access to new Medicare beneficiaries and specialists, alike. As a business that could be the difference between being profitable or not.

Consider this: would you rather an ACO pay a competitor for services that you provide? For example, providing or increasing after-hours care can help reduce emergency room visits. Additionally, it could mean reduced “leakage” of services or identifying opportunities, where services might be limited, for new partnerships or lines of business.

How do ACOs hep you increase provider network reach?

Gone are the days of paper pad referrals. That means ACOs are required to have current technology to coordinate care effectively with participating providers, such as a physician network management system. This system, for example, lets physicians quickly filter and find physicians and manage cross-organization communication to ensure that quality of care standards are met.

To ensure the highest quality of care, providers are accountable to patients even if they go out-of-network. Therefore, it’s essential to stay current on other providers that the patient may be seeing and build relationships with them. Furthermore, because ACOs require you to have a minimum of 5,000 providers within your network to receive shared savings, it’s essential to increase network reach. Otherwise, if participation falls below that number, providers could potentially see losses instead.

4. Increased retention and acquisition of patients

Although Medicare automatically enrolls patients in ACOs, non-Medicare patients, who understand the benefits involved, can be encouraged to participate in an ACO. Unlike HMOs, patients become the focus (not the insurance companies). Healthcare providers communicate more efficiently and tend to make better-informed decisions because of specific quality standards that determine the savings they receive. This results in better care, and, therefore, enhanced retention (and acquisition) of patients. Simply put, patients who receive better care are more likely to stay, and encourage other beneficiaries to follow.

Although Medicare automatically enrolls patients in ACOs, non-Medicare patients, who understand the benefits involved, can be encouraged to participate in an ACO. Unlike HMOs, patients become the focus (not the insurance companies). Healthcare providers communicate more efficiently and tend to make better-informed decisions because of specific quality standards that determine the savings they receive. This results in better care, and, therefore, enhanced retention (and acquisition) of patients. Simply put, patients who receive better care are more likely to stay, and encourage other beneficiaries to follow.

It’s important to keep patients within the care of participating providers because the ACO handles the associated expenses regardless of whether or not the patient receives care outside of the ACO. Furthermore, if patients seek care elsewhere, they could be dropped from the ACO, which puts the ACO at risk for qualifying as an ACO if enrollment numbers fall below 5,000. Therefore it’s to the ACOs advantage to effectively manage care coordination and expenses, and close care gaps to prevent patient leakage.

How do ACOs help you increase patient retention?

Within the Patient/Caregiver Experience domain of the 33 quality of care measures, 7 of those measures revolve around patient care which includes:

- providing timely care, appointments, and information

- effectively communicating with patients and providers

- ensuring office staff is helpful, courteous, and respectful

- receiving high care rating from patients

- promoting and educating patients on preventive health

- sharing decision-making with participating providers

- properly reporting on patients’ health status

By enforcing these quality measures, patients receive better “customer service,” which results in greater patient satisfaction, and, therefore increased retention of those patients.

5. More control over patients’ care

In contrast to HMOs, ACOs are physician-led and centered around the patient’s needs, not the dictation of insurance companies. While it may seem like ACOs are just repackaged HMOs with more bells and whistles, they’re quite different. Government incentives and cost savings benefits are a factor of quality outcomes rather than the volume of services. Aligning incentives with results allows the control to be put back into the hands of primary care physicians.

Physicians are therefore able to administer the appropriate care, rather than unnecessary tests and procedures for the sake of reimbursement. Moreover, patients can get the attention they deserve. According to a CMS evaluation, there was a substantial increase in the proportion of patients seen by a physician within 7 or 14 days of a hospital discharge. 59% of respondents from the HIN survey also said hospital admissions have declined as a result of accountable care. These results demonstrate that despite being a managed care program, ACOs enable healthcare providers to make decisions that are best for the patient.

The simple fact is this: it’s difficult to provide exceptional care without effectively collaborating with other healthcare providers. That requires all participants to be in alignment with the quality standards that are evaluating the performance of the care delivered. In turn, that forces providers to work together for the sake of the patients to meet those benchmarks to [collectively] reap the financial rewards.

How do ACOs help you achieve control over patients’ care?

Because ACOs are required to reduce costs by focusing on quality of care, rather than volume of services, control is put back in the hands of the healthcare provider (not the insurance companies). In turn, this allows physicians to be more proactive about a patient’s care.

ACOs allow physicians to be more proactive by encouraging preventative health, which is one of the four domains of the quality of care measures. Within the preventative health domain, the quality measures that must be met include:

- Pneumococcal Vaccination

- Adult Weight Screening and Follow-up

- Tobacco Use Assessment and Cessation Intervention

- Depression Screening

- Colorectal Cancer Screening

- Mammography Screening

- The proportion of Adults who had blood pressure screened in the past two years

By focusing on preventative health and other key measures, physicians can ensure that the patient is receiving the care that they need and not services that they don’t.

6. Access to more advanced technologies

For providers to deliver the highest quality of care, it’s important to have the right infrastructure and technology in place. According to a HIT survey by Premier Inc. conducted between July and August of 2014, 60% of ACOs said technology improved care quality while 55% said it improved overall health outcomes.

One of the greatest benefits of joining an ACO is that you get access to better back-end operational and administrative technologies that you might not normally get (or be able to afford) as a sole practitioner. These systems allow health providers to share information more smoothly from one provider to the next to better manage the care of the patient. In other words, by having better technology in place, the patient truly becomes the focus of care. For example, patients will spend less time filling out medical history forms or waiting for medical results because the information will be electronically available. For healthcare providers, they’ll be able to mitigate risk, ensure HIPAA compliance, and grow their personal referral network.

However, regardless of whether a practice or healthcare organization joins an ACO, it “will need to integrate systems that improve communication, care coordination, and quality measurement reporting says the American Medical Association.

How do ACOs help you access advanced technologies?

Through partnering with other physicians, hospitals, practices, and healthcare systems, providers can access advanced technologies that they may not otherwise have had due to budget or other constraints.

Of the 33 quality of care measures, 17 of them must be reported through a Group Practice Reporting Option (GPRO) Web Interface. This Internet-based application helps the CMS determine what PQRS (Physician Quality Reporting System) payment adjustments need to be made. For example, the PQRS, a voluntary quality reporting program applies a negative 2% payment adjustment to practices with professionals or group practices participating via the GPRO, who do not satisfactorily report on measures.

Conclusion

While physicians everywhere are starting to recognize that joining an ACO can result in notable financial success, others remain skeptical. Those who are skeptics might want to consider whether they have the right infrastructure in place to support ACO business. Because data analytics poses the greatest challenge to ACO operations, according to one-third of HIN survey respondents, it’s imperative to consider the technology that’s in place for all participants. When data is fully accessible to participating healthcare providers, organizations can more quickly identify target patients, intervene to improve health, track compliance, create alignment between physicians, and ensure meeting of performance standards. In other words, capturing, analyzing, and sharing data using the right technology is crucial to the financial success of an ACO. Otherwise, it could mean its demise.