The success of value-based care as a cultural and economic target in U.S. healthcare rests on the back of the Accountable Care Organization (ACO.)

A history of fee-for-service care has left the industry struggling to get a handle on skyrocketing spending and questionable quality standards. ACOs presumably address these issues by coordinating hospitals, doctors, and the rest of the community of providers to administer truly coordinated care. ACOs as implemented by CMS programs are a testing ground of the concept where bumps and problems are worked out in smaller, more controlled patient populations.

This article will address some of the most recent results of ACOs, how payors are innovating on the concept, Medicare’s progress into a new generation of care organizations, as well as provide advice on ethical referrals within the new ACO environment.

ACOs Working For Medicare, But Provider Results Are Questionable

The Medicare ACO rollout has been a gradual one with initiatives focused on specific health systems and regions. One of the most prominent has been the Dartmouth-Hitchcock Health System (DHS) in northern New England.

The system has been working on a population health-based strategy since 1983 and in 2005, it entered Medicare’s Physician Group Practice (PGP) demonstration project. DHS had a goal of 85 percent of Medicare reimbursements coming from quality or value-based care by 2017 and Dartmouth had been a growing example of how the goal could potentially play out in other health communities.

The results seemed promising with Dartmouth maintaining the sixth lowest per capita expenditures in Medicare’s Pioneer program and continuing to save CMS substantial amounts of money in 2014. In September of this year though, the system decided to exit the program joining 13 of the original 32 other organizations who had dropped out.

The withdrawal came as a result of increasing costs for the system. Dartmouth had achieved a reduction in annual per-capita expenditures of 3.9 percent along with generating cost savings of around $16 million dollars, all while maintaining high levels of care quality. Still though, care costs were beyond the CMS target and the system received penalties of $1.4 million in year two of their ACO and $3.6 million in year three — a stark contrast to the $1 million incentive payment received in their first year.

This experience is not uncommon across the ACO environment. Medicare has seen programs savings of about $411 million in 2014, but under 100 of the over 350 providers participating in the program received an actual bonus payment. This though, wasn’t a surprise to the National Association of ACOs (NAACOS) who were disappointed, but understood the drop in savings for individual care organizations. According to Clif Gaus, CEO of NAACOS,

“This is probably due to the unfair quality penalty, which is so stringent that unless an ACO scores perfectly on every quality measure, their savings will be reduced. We expect ACOs to deliver better care for Medicare beneficiaries, but the quality benchmarks that CMS prescribes are the government example of letting the perfect be the enemy of the good.”

Many in the industry acknowledge the issues around the current government model, but see these issues as necessary growing pains in the move to value-based care and a valuable educational experience for providers who are engaged in similar ACO programs.

Private-Payer ACOs Not Producing As Expected

The private sector isn’t waiting to see the long-term results of government ACO programs. Many doctors and hospitals have launched their own versions in collaboration with private insurers and perhaps unsurprisingly, are seeing similar results.

At a recent event held by America’s Insurance Plans the issue of providers and insurers improving their efforts in reaching

patients and employers was addressed by physician executives and four, large health insurance companies. Dr. Stephen Odra, who serves as chief medical officer at Health Care Service Corp. reported that their alternative payment models are not succeeding at the rate they’d hoped and that “consumer engagement is very, very low” according to Modern Healthcare.

In response to Medicare’s ACO initiatives, private payors have jumped on the ACO bandwagon and contributed to the 744 public and private ACOs that the country houses as of the first quarter of this year. The number during the same period in 2011 was only 64. Involved in those organizations are 132 insurers who span Medicare and state Medicaid agencies as well as regional insurers and national carriers. The number of insurers with at least one ACO contract was previously only 44. With all that growth however, there has been little monitoring of how the ACOs are actually performing once they are formed.

Cigna alone has more than 130, large-group ACOs, but only 58% have managed to both lower cost and improve quality. According to their chief medical officer, Dr. Alan Muney, a part of the problem is that doctors are still reimbursed based on volume. ACOs that have been successful have management to tie doctor payment to quality, patient satisfaction, and safety — a trait that is likely essential to long-term ACO success.

On the patient side, most engaged in these ACOs likely aren’t even aware that anything has changed in their healthcare.

In Illinois, HMOs have actually been outperforming their local ACOs. Blue Cross Blue Shield of Illinois has made multiple ACO pacts, one of the largest of which is with Advocate Health Care which stands as one of the largest ACO’s in the U.S. Still the insurer has noticed that the ACO is underperforming in terms of cost control and quality improvement in comparison to HMOs — something that’s likely due to consumer engagement and clarity around HMO benefit design.

Cambia Health Solutions in Oregon, who started building ACO agreements in 2013, is having a similar problem around consumer awareness. It now has almost 40 different accountable care ties.

Self-funded employers have shown less eagerness in jumping into the ACO game, likely because the nature of their business involves risking their own money. They might support the idea of value-based payments, but the concept is a different question when their own funds are at risk.

The Next Generation Of ACOs

Smart providers will be preparing themselves for the possibility of joining ACOs, and that will require understanding what might be coming down the ACO pipeline.

Medicare began its work of ACOs with the implementation of its Pioneer program, but after having learned lessons from both that and the Medicare Shared Savings program, it is launching its Next Generation ACO model. This new model offers multiple important differences including

- Aims toward higher standards of care quality

- More opportunities for providers and beneficiaries to coordinate care

- More predictable financial targets

The Next Generation Model is designed for providers who already have experience coordinating care for patient populations. Participating providers will be permitted to assume more financial risk than they could under the Pioneer Model or the Shared Savings Program in an effort to evaluate whether combining greater ACO financial incentives with better tools that support patient engagement and care management can possibly reduce spending and improve outcomes for Original Medicare beneficiaries.

The Next Generation Model goes further in the patient-centered goal of the ACO concept through a structure designed to bring patients higher-quality care through stronger patient protections.

Communication is everything in ACOs, and it is vitally important that a health system manages its’ specialty care network effectively with programs such as referralMD which help coordinate the patient between organizations; 2-way messaging, file exchange, and automated workflows and reporting for department level staff.

It does hold some similarities to the previous models in that evaluation will be based on ability to deliver better health to populations and to individuals, as well as lowering spending. These goals were created to align with DHS’ “Better, Smarter, Healthier” orientation toward addressing healthcare care in the U.S. and establishing “clear, measurable goals” as well as a timeline that the national healthcare system should be moving along with. Ultimately, HHS is working toward reimbursing providers based on care quality instead of the quantity of care they are providing patients. CMS will also provide public reports of the Next Generation ACOs along with metrics such as patient experience on its home website.

Right now, CMS expects to have 15 to 20 to join in the Next Generation ACO model with those participants representing a diverse spectrum of geographic regions and provider organization types.

ACOs that are interested in applying can visit the electronic submission portal where they can submit an LOI and complete the application.

CMS has been accepting participants through two application rounds in 2015 and 2016. Participation is expected to last up to five years. Round one has passed, but round two applications will be available in March of next year. Round two LOIs should be submitted electronically before 11:59PM EDT, May 1, 2016, and the application must be submitted no later than 11:59 PM EDT, on June 1, 2016.

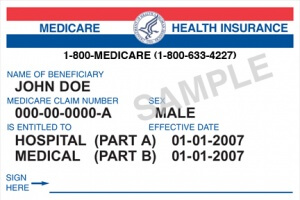

Provider participation in the Next Generation ACO is completely voluntary and your patients’ Original Medicare benefits will be unchanged. They will also maintain their freedom to visit any Medicare provider they wish.

Influencing Referrals In ACOs

Managing referrals in ACO environments touches on an entirely new dynamic in the patient management process. You’re under more pressure to ensure that patients remain in the same network while at the same time, doing so in a way that is legal, ethical, and places patient needs as a top priority. This is especially important since ACOs are responsible for patient expenditures whether they occur inside or outside of their organization.

Creating ethical referral policies and patterns may require planning and rethinking your orientation toward referrals, but it is possible to do so while showing respect to your responsibilities to patients and their autonomy.

According to the NEJM, transparency is incredibly important in creating ethical referral processes around ACOs, and you have several options in achieving it.

- Keep things public: You can maintain public-notification requirements or even public websites which serve as an access point of general disclosure of the ACOs use of preferred referrals, as well as the rationale behind them.

- Be open about metrics: You will also need to select metrics that go deeper than cost and reflect ACO values of quality of care and patient focus. Referrals should not be influenced purely on cost since health outcomes and care experiences should be centralized. Also, physician preferred referral lists should not conflict with patient well-being. It is additionally advisable to keep patients aware of the kinds of metrics that are used to evaluate referrals.

- Address patient concerns: Factors including location, racial, cultural, and gender concordance, as well as communication skills and scheduling time should be made accessible to patients.

The Stark Law Question

ACO referrals also touch on legal complications, including how they bump up against older laws and regulations established before their time. One of the most prominent issues is intersection with the Stark Physician Self-Referral Law.

CMS has already acknowledged the fact that operating ACOs will likely implicate Stark in many different ways. As the agency says, “when a participating physician receives a portion of the cost savings attributable to his or her efforts in reducing waste…a financial relationship is created between the hospital…and the participating physician.”

To stay on the safe side of the law, referrals within an ACO will need to either qualify for a waiver, or satisfy one of Stark’s exceptions to avoid liability under the statute. For physician group practices and multi-specialty groups to qualify for exceptions, they must be properly classified as a “group practice” under Stark and meet corresponding regulations if they are to avoid civil sanctions, civil monetary penalties, qui tam liability under the civil False Claims Act, inter alia, or exclusion from Medicare, according to the Journal of Law and Health.

Being classified as a group practice under Stark can cause some very specific problems since (under the Single Entity Test) a group practice cannot be owned in any way by an entity that is operating as a medical practice, and that includes hospitals. This type of arrangement is very likely under many ACO structures.

Full-time independent physicians may also find themselves in a position where it is difficult to meet the service provision requirement since Stark requires that physician members in group practices provide at least 75% of aggregate services within the group. This requirement does not consider the possibility of physician-hospital collaboration beyond hospital ownership of practice and does not consider hospitals or other members within an ACO to be a member of the practice.

The waivers that allow Medicare ACOs to operate outside of the restrictions of self-referral laws were extended until November 2, of 2015.

Need a better way to manage your ACO relationships and drive referral volume?

ReferralMD is here to help you navigate the ever-evolving ACO landscape. Schedule your demo today to start your organization on a path to optimal ACO relationships.