Revenue cycle management (RCM) is the backbone of the healthcare industry. It manages the providers’ finances and keeps them going daily—several organizations are involved in the process to make it a success. The role of medical billing services in the US and the front-desk staff is undeniable. We will look at how each of those departments improves payments for the physicians and other clinicians.

What is Revenue Cycle Management?

Revenue Cycle Management or RCM is a process that takes care of financial cycle management. RCM works at the functional core of a healthcare organization, whether it is a small medical practice or a large hospital. Each institution by law has to follow certain procedures to remain profitable, so the process of care delivery steadily moves on. In the wake of this current argument, it is appropriate to mention the key stakeholders in this process; Physicians, patients, and the payers.

Physicians and patients are directly part of the care delivery process, but the payers participate in it as an engine and are key players. The revenue motivates both the doctors and the patients. The skyscraper of the healthcare industry comprises several basic building blocks to execute an end-to-end revenue cycle management process.

If there are loopholes and/or outstanding accounts receivables, they directly affect the income of a practitioner. The aftershocks of a lazy revenue cycle can cause major backlogs regarding pending claims for the physicians.

Medical Billing Services in the US Play an Anchor Role

An effective revenue cycle management process in medical billing is what most medical practices strive to achieve. It is mostly the third-party medical billing and coding companies responsible, assuming they have the experience and skillset. It is interesting to compare medical billing services in the United States to an anchor. They connect the providers to the payers like an anchor connects a ship to the shore.

To run a productive healthcare RCM process, it is imperative to hire an experienced billing service. Whether you believe in outsourcing the medical billing or using an in-house specialist, a slight deviation from a certain level of attention could mean failing at the whole process. Filing claims at the right time leads to quicker reimbursements. It requires certain skills and a combination of both novice and veteran billers.

9 Steps in Revenue Cycle Management

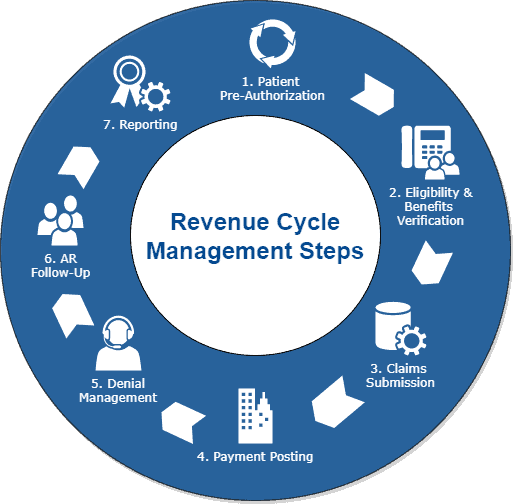

While there is no replacement for high-quality care, there is literally no denying the importance of following the 9 steps of revenue cycle management.

As explained in recent publications, AI or Artificial Intelligence will boost the efficiency of a revenue cycle management system by acting as the digital employee to the physicians.

Photo by on Pexels

Let’s look at the revenue cycle from beginning to end to educate ourselves in the best interest of care and healing.

- RCM Software or A Medical Billing Outsourcing Company

The first step in claims management is to decide whether to install RCM software in-house. Or, do you hand over the task to a revenue cycle management company? Don’t fret because it gets easier when you outsource medical billing services with skilled IT personnel to file claims, work on denials, and appeal on your behalf.

To search for a billing company that fits your practice, physicians usually search for the phrase “medical billing companies near me” in Google. It gives you the list of companies close by.

It is only logical to look for revenue cycle consulting companies near you when you don’t have expert IT staff members in your medical practice. When you run a small practice with able IT crew support, it is ideal for running an RCM software set up on local servers. However, larger organizations or those lacking skilled staff consider medical billing services in the USA as the best practice.

- Patient Pre-certification or Pre-authorization

What is it? When a patient comes in, they undergo pre-authorization. The physician’s office pre-approves the patient for certain treatments and prescription drugs through this process.

At this step, the payers or the insurance companies decide whether the prescription drugs, procedures, services, or equipment is medically necessary or not. Based on the decision, they will reimburse for the services rendered. The pre-authorization phase faces exceptions in case of a medical emergency.

Pre-authorization doesn’t necessarily mean that the health insurer will cover its cost, which is why the process is repetitive and needs continuous verification. It is always a good idea to double-check any doubts related to coverage with the insurance company. This goes for both the providers and the patients.

- Insurance Eligibility and Verification

The process is downright demotivating over the phone because it demands a lot of patience. Therefore, a set function must be a part of the RCM software to cater to it. Artificial Intelligence could play a pioneering role in this phase of recognition, as it will automate the function.

Once patients go through with the care delivery, the Explanation of Benefits (EOB) statement incorporates all the details of the services or treatments paid on their behalf by the insurance company.

- Charge and Code

When the patient checks in at the office, the visit transforms into a set of codes. There is a high probability of human error in these codes, which is why competent medical coders are the key players in this process. The codes have to follow a certain set of rules and concur with the CPT guidelines and the latest ICD-10 coding system.

- Co-payments and Deductibles

Each health plan comes with a deductible and a co-payment. Some have high, and some have low deductibles. Whatever the amount is to be, the patients pay up the copays at the doctor’s office before returning home. The deductible is the amount fixed in a health plan that you have to pay before the insurance company starts paying for those health care services.

- File Claims

Submission of claims is the vital stage in the overall process because the reimbursement directly depends on it. If it is flawed, the chances for reduced payments or outright denials increase. As soon as the biller prepares the claims, they are filed with the insurance companies via a clearinghouse. The clearinghouse makes sure they are clean and free from errors.

Internally when practice management software connects with the medical billing software, it will initialize the operational process of the revenue cycle management. The billing company follows up with the insurance company in light of those claims. It ensures the payer reimburses on time.

- Reimbursement for the Services Rendered

It is time for the insurance company to pay up. The payers match the procedures with their charges under the coverage limit. If the bills are appropriate, the process of acceptance becomes smoother and returns maximum reimbursements.

In the case of erroneous claims, incomplete patient information, or any other issues, denials are inevitable. Most low-dollar claims tend to pile up unless the RCM is playing to its full potential.

- Manage Denials

For the claims which suffer rejection, they are resubmitted soon after they are scrubbed for coding mistakes. The resubmissions or appeals process demands critical screening with a finger on the pulse of the latest coding guidelines. In addition, minute details are checked against the patient profile, making the billers work directly with the payers.

- Collections

When there is reduced reimbursement from the payers, the health plan does not cover all the services. Thereupon, it is the duty of the billers to send those outstanding payments to the patient(s) and follow-up.

Medical billing services do rigorous follow-ups until the patients finally pay up.

Photo by Bermix Studio on Unsplash

With all the above steps in place, it helps streamline the complex process of revenue cycle management. Physicians need a proper team of individuals to carry the process towards the finish line by successfully executing these stages. On the contrary, the denial rates even for a team of veteran billers are about 10%. As long as they don’t back down and continue to work for acceptance & maximum reimbursement, the payers will pay for your services as a healthcare professional.

Steps for HIPAA Medical Billing Outsourcing

First, physicians must acquire the services of medical billing companies nearby. Second, they must see if they demonstrate HIPAA compliance. OCR audits only spare those practices with a credible security system in place, providing maximum safety to protected health information (PHI). Any covered entity or business associate choosing to violate HIPAA is subject to hefty fines and jail time.

Medical billing services charge 3 to 7 percent of the total collections as their fee.

The top attributes of a genuine medical billing service provider are as follows:

- Medical Claims Scrubbing – While the billers prepare those claims, the coders keep a close eye on any mistakes before they are ready for submission. Certified coders from organizations like AHIMA can really kick it up a notch for providers.

- Follow-Up – A good medical billing company will always stay on its toes until a claim returns positive results. It continues to follow up on pending claims and exhibit accounts receivable (AR) management regularly.

- Denial Management – Not every claim passes through the strict criteria of the payers in the first go, which is why active billers re-work denied claims for the physician through accurate resubmissions. They do everything in their capacity to reimburse your services successfully.

- Weekly Reporting – When the physicians give you responsibility for their finances, you must email them a detailed report regarding the performance of their claims. You may do it weekly or bi-monthly basis. The frequency of those reports depends on the Business Associate Agreements (BAAs).

- Dedicated Accounts Manager – The reliable medical billing services appoint an accounts manager to act as a liaison to the physician because communication is an important part of the contract. It also includes an additional support team of individuals to address any issues in the claims.

The Revenue Cycle Management Flow Chart

When the administrators remove any obstacles in the revenue cycle management process, it puts claims on the path of first-time acceptance.

The following diagram represents the revenue cycle management flow chart in its true magnificence.

The Vendors

A long list of revenue cycle management vendors provides a permanent solution to your financial cycle needs. However, selecting the right one may be difficult given the range of services and bonus features that come along. Some of those solutions integrate with the certified EHR systems to speed up the entire system.

Performance Calibration

How do we know if the billing service is performing well?

The question is simple, and it needs a straightforward answer.

We know a billing company is performing well with an increase in collections and a consistent cash flow. In other words, there are no hiccups.

Simply put, the volume of interactions with the insurance companies requires medical billing services either in-house or outsourced to manage your finances. When they are established, you can focus on patient care confident your revenue stream is in good hands.

In Conclusion

To stay positive, with great billing support comes a much healthier practice (financially). Success requires attention right from the beginning when a patient comes in to receive care. The person sitting at the reception is going to run patient eligibility checks and commence the pre-authorization phase.

Nobody said the medical billing process is an easy one, but it becomes highly manageable with the right steps, (add billing specialists) in place. Use the right medical billing software, RCM tools, and potentially third-party medical billing services to put your practice on its way towards financial freedom.

Learn how ReferralMD’s prior authorization tool can improve your revenue.