As we continue to embrace the digital age, technology has become integral to every aspect of our lives. What is role of technology in healthcare insurance today? Technology’s influence is pervasive, from communication to education, e-commerce travel to healthcare. However, the insurance industry, the backbone of our society, needs to adapt to rapid technological advancements. In this blog post, we will explore the inefficiencies of traditional healthcare insurance processing methods and the potential benefits of incorporating automated and AI-powered solutions into the healthcare industry.

Photo by Ali Shah Lakhani on Unsplash

Challenges with Traditional Insurance Processing

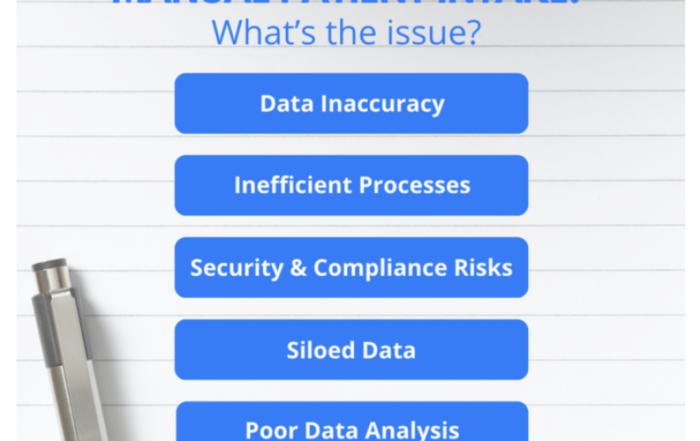

The traditional methods of insurance data intake and processing pose several challenges. These challenges result in wasted time, increased costs, and accuracy issues, causing frequent claim denials. Denied health insurance claims amount to over $262 billion annually. Many of these errors occur during patient registration, a process heavily reliant on manual labor. However, the overreliance on humans is only one part of a more significant issue.

Shortcomings of Traditional Insurance Processing

Four key contributors contribute to the shortcomings of traditional insurance processing:

- Geographic Barriers: Insurance companies, such as BlueCross BlueShield, Tricare, and Medicare, have specific state, local, and zip claim processes. Failure to identify the correct locality can lead to claim denials, necessitating knowledge of differences between different areas across the United States.

- Human Expertise: Traditional processing methods require human experts to be familiar with various policies, types of insurance cards, and insurance payer IDs. However, most insurance cards need to indicate this information, making the training and utilization of workers easier. Additionally, human intervention is prone to errors. The average error rate in the health insurance industry is nearly 20%.

- Limited Digital Systems: Existing digital systems for insurance processing must improve their ability to decode information not printed explicitly on a card automatically. This reliance on human intervention slows the process and becomes a roadblock when providers issue digital insurance cards, rendering traditional capture methods ineffective.

- Denied Claims: Ignoring these issues leads to errors in identifying payer information, incorrect data entry, inaccurate coverage determinations, and similar issues, resulting in denied claims. This burden is passed on to insurance providers and consumers, making insurance management more challenging.

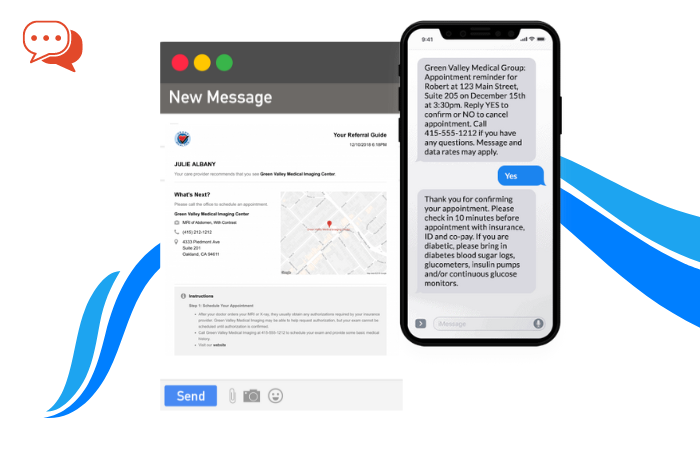

Unlocking the Potential of AI-Powered Insurance Processing

The limitations of manual and traditional insurance processing methods have led experts to explore AI-powered solutions, which have the potential to revolutionize the insurance industry. Early developments in AI technology have demonstrated promising results. These AI models can be trained on over 4,000 insurance payers and over 20,000 insurance plan types, which is astonishing compared to human capabilities.

Benefits of AI-Powered Insurance Processing

The benefits of incorporating AI-powered systems into insurance processing are numerous:

- Speed and Efficiency: AI-based models, equipped with algorithms that validate information, can complete insurance processing tasks in less than 5 seconds, significantly improving over the traditional methods that took several minutes. This efficiency saves time for both claim holders and insurance providers.

- Cost Savings: Modern models can save insurance companies an average of 80% in processing costs. These savings can be reallocated to other areas, driving innovation and improvement within the industry.

- Improved Accuracy: AI algorithms can identify critical information in real time, minimizing the chances of errors compared to human-driven processes. Furthermore, AI models can adapt and update regularly, ensuring they stay up-to-date with evolving insurance coverage and policies.

- Employee Experience: AI technology reduces the strain on employees by automating repetitive and time-consuming tasks, minimizing the chances of burnout and turnover. Streamlining the insurance processing workflow enhances the overall staff experience.

The Path Towards Transformation

The healthcare insurance industry must embrace technological advancements to serve the people and economy effectively. Insurance providers can eliminate inefficiencies, reduce costs, and improve customer experience by adopting automated and AI-powered solutions. The benefits outweigh the limitations of traditional methods, paving the way for future success in ways previously unimaginable.

It is crucial to recognize AI technology’s current role and potential in modernizing insurance processing in the healthcare industry. Let us embrace this change and witness its positive impact on the industry as a whole.