New reasons loom for healthcare providers to move toward price transparency. One involves components of the new administration’s focus on replacing the Affordable Care Act.

Any standard the government may set is likely to pale with existing efforts of early adopters and emerging mobile technologies. Just as the military was called out in the 1980’s for spending $640 on toilets seats, healthcare is now in the cross hairs of fiscal spending. Healthcare will need to perfect the art of evasive maneuvers or achieve cost transparency. Today’s most innovative mobile apps provide customers with more than their own healthcare costs on-demand.

Trends that can’t continue, won’t – Herbert Stein.

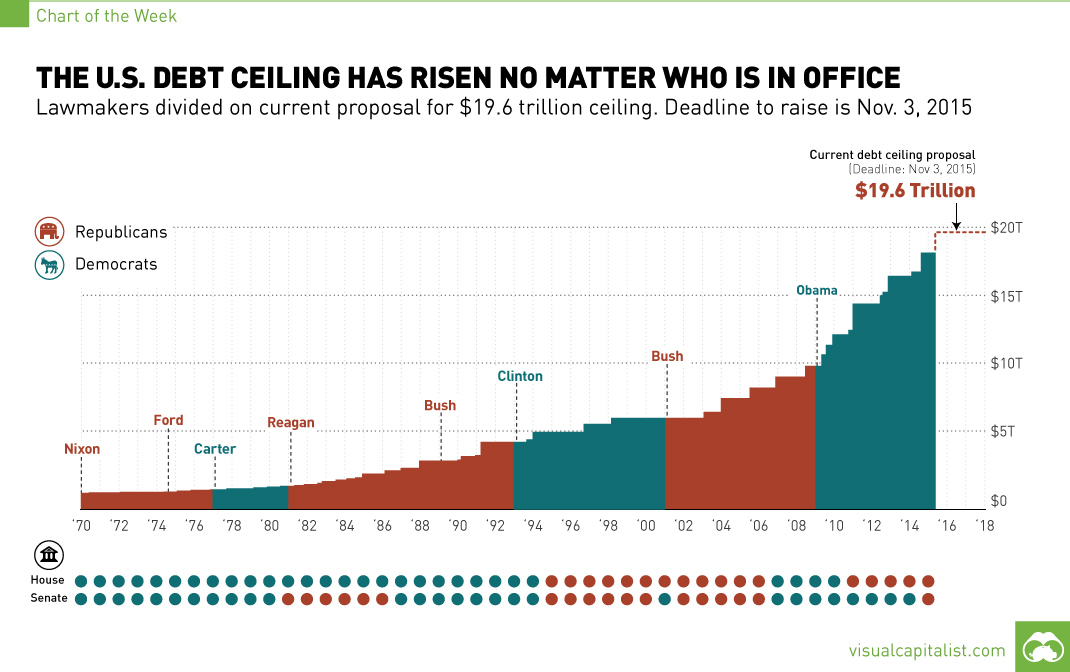

Calls for healthcare price transparency are not new, just more urgent. Healthcare spending exceeds $3 trillion, 17% of our GDP, with total national debt exceeding $20 trillion. Despite the Affordable Care Act, healthcare costs, monthly health insurance premiums and deductibles all continue to soar. The average “silver plan” deductible is over $3,000. Concurrently, the Federal Reserve indicates that over half of Americans cannot afford a $400 emergency without relying upon credit. According to Harvard University, a full 60% of personal bankruptcies are directly related to medical expenses.

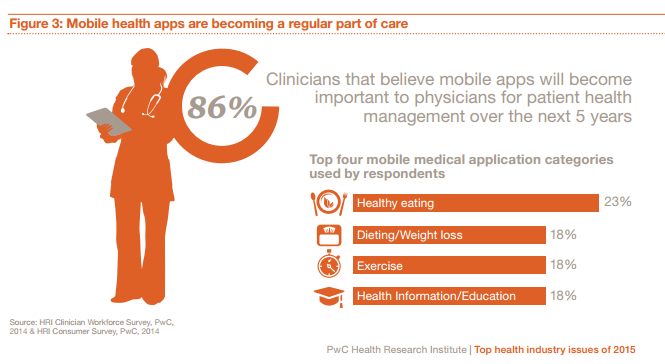

How much does it cost? Nearly 70% of Americans use their smartphones to shop around. The price of any product or service is readily available, except when it comes to healthcare and medical procedures in most states. Americans are just beginning to think about shopping for healthcare according to the Health Research Institute. Their 2014 survey found that 26% of Americans contacted healthcare providers about prices, and climbing to 30% in 2015.

Thus, we have the fifth point of the new administration’s healthcare plan, and it reads as follows:

Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. Individuals should be able to shop to find the best prices for procedures, exams or any other medical-related procedure.

Whether we like it or not though is sort of irrelevant. It sets the bar very low. For customers, the ability to see costs up front will be seen as an improvement. But even then, due to additional complexities, this doesn’t tell the customer how much they will actually have to pay. And it is in this sense that healthcare price transparency, unto itself, falls far short of what can be done, and what some healthcare providers and insurance companies are already doing, if with different approaches.

Insurance Policies and Reading Comprehension Tests

For the price of a healthcare procedure to be meaningful, it needs to consider the customer’s insurance policy and other financial factors. Most Americans have insurance policies, but how well do they understand them? What is a deductible, co-pay, co-insurance, out-of-pocket maximum, or in-network provider? And when do they apply? Going back to 2013, a Carnegie Mellon University study (available here) showed that 86% of their survey participants had difficulties with these terms.

For the price of a healthcare procedure to be meaningful, it needs to consider the customer’s insurance policy and other financial factors. Most Americans have insurance policies, but how well do they understand them? What is a deductible, co-pay, co-insurance, out-of-pocket maximum, or in-network provider? And when do they apply? Going back to 2013, a Carnegie Mellon University study (available here) showed that 86% of their survey participants had difficulties with these terms.

Their findings are not particularly surprising when considering how most insurance policies are obtained. Employees typically receive insurance enrollment forms and packets from employers to read and complete. If not covered by employers, under the current ACA mandate, customers decide between the insurance companies available and the policy they can afford. Does everyone read the policy handbook, understand and retain it? Does everyone comprehend their explanation of benefits (EOB) statement after a medical visit?

The Cost of Not Knowing the Cost

Practically speaking and more importantly, what’s the benefit if customers cannot find and compare prices? Jonathan Bush, CEO and president of Athenahealth, Inc., noted that the price of an MRI at one hospital was $1200. At another hospital just two miles away, it was nearly $3,000. At another hospital just twelve miles away, it was under $700 – all involving the same MRI with the same machine make and model.

Let’s look at it another way. According to the Organization for Economic Cooperation and Development (OECD) there were roughly 33.8 million MRI’s administered in the United States in 2013. If everyone was paying $3,000 for their MRI, the total cost would run $102 billion. If everyone opted for the $700 MRI, the cost would run just $24 billion – a difference of $78 billion, more than the GDP of the entire state of West Virginia. While an oversimplification, this one line item underscores that the broader $3 trillion healthcare market is not well optimized.

In another example, a total knee replacement costs nearly $70,000 in New York City, but less than $12,000 in Alabama. Prices will naturally vary from one provider to the next, under a free market. That’s not the issue, merely the ability to know the price upfront. Ordinarily, this would be a great time to quote Donald Rumsfeld!

While the data exists, it’s not shared very well. That’s changing, driven by a combination of increasing financial concerns and technology. It can be argued that technology is developing faster than we can adapt to it. Mobile technology, in particular, crossed the financial viability threshold in 2013, while the Internet was considered a passing fad until finally accepted as mainstream around 2004. While most have adapted to the Internet, the market is still adjusting to the potentials afforded by smartphones and related mobile technology.

Numerous state governments, healthcare providers, insurance companies and third party developers have presented a variety of solutions. Their success has varied, suffice that it is appropriate to take a look at some of the key players and most innovative solutions.

State Laws and Databases

Mandated by state governments, All-Payer Claims Databases or APCD’s collect data from multiple sources including all manner of private insurers, health benefit programs, Medicaid and Medicare, if available. State by state implementation means APCD’s, or any other transparency measure, can vary widely from governance and funding to the data, structure and access.

Many interested in healthcare price transparency are already aware of the July 2016 “Report Card on State Price Transparency Laws” by the Health Care Incentives Improvement Institute and Catalyst for Payment Reforms. If not, we can quickly summarize that 43 states received an “F”. Colorado, Maine and New Hampshire received an A-grade, with Oregon earning a B. The common denominator for the best performing states is having an All-Payer Claims Database (APCD) supported by good websites for consumers. Grading of the APCD was based on having an accessible rich data source with meaningful price information, spanning a scope of services.

These best performing states have one other point in common – laws committed to supporting healthcare price transparency. Likewise, the vast majority of the 43 states that didn’t pass HCI3 ’s test do not have such laws or allowed for voluntary participation. In some cases, states may have had functional APCD’s but lacked an effective web site. Nevertheless, several states are in the legislative process while numerous others have a strong interest in starting, adding to the existing trend.

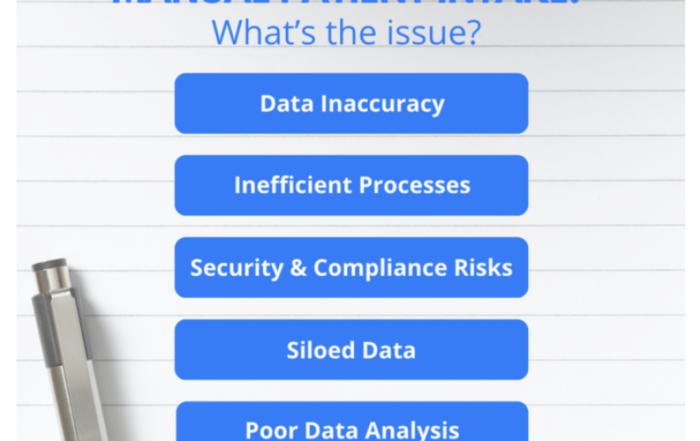

One of the core issues limiting the effectiveness of APCD and their associated web sites is limited customer awareness. While useful for price referencing, raw data falls short in not being able to factor in insurance policies.

Hospital Price Transparency Initiatives

Baptist Health System, comprised of a seven hospital system in Florida, started its price transparency initiative in 2001. It maintains a Central Pricing Office (CPO) with seven employees. This office provides estimates for pre-registered services and on-request for all hospital care and physician services. Pre-registered patients receive a letter detailing what they will receive, and an upfront estimate of out-of-pocket expenses, factoring deductibles, co-pays and co-insurance. Other patients receive the same information at registration. Individuals unable to afford care are connected with a financial aid officer to assess if they may qualify for various assistance programs. Each estimate is effectively custom-created, but prices are not maintained on their web site.

Holy Cross Hospital in New Mexico, Northwest Medical Center in Tennessee, Saint Joseph’s in Washington, among others, maintain similar transparency efforts. Many of these post the prices of the most common services and procedures on their web sites. Almost all rely upon chargemaster data and related software for estimates. Employees are trained to script their estimates to customers so that they know there could be additional costs. Some, like Littleton Regional Healthcare in New Hampshire engage to estimate those additional, often specialist-related costs, too.

More recently, Missouri Delta Medical Center was acknowledged by the Healthcare Financial Management Association as one the smallest of the Top 100 adopters of its Communication Best Practices. Going beyond informing patients of their financial responsibilities, they’ve implemented a variety of payment options for procedures not fully covered by insurance. In addition to knowing procedure costs upfront, patients have access to two and four year payment plans, some qualifying for zero-percent interest. One advantage observed thus far is that patients are less likely to cancel procedures. Moreover, less anxiety over their financial health, patients can focus on their physical well-being.

Online and Mobile Tools

A multitude of web and mobile apps are available to make it easier for customers to find highly specific healthcare price data. Many merely serve as price referencing tools, suffice that even these are a giant leap forward for customers who may not have access to other options. The following takes a quick look at three pricing platforms which set the standard one should expect and by which the vast majority of all others come up short.

- UnitedHealthcare is an insurer with their own online transparency tool and mobile app (Health4Me) offering numerous features. It enables customers to search for physicians and providers by location or specialization; locate ER’s and urgent care facilities, and connect with a registered nurse 24/7. It also helps customers estimate health care and drug costs, check the status of deductibles and out-of-pocket spending, among many other features. This is an insurance-company based solution and thus limited in use to their policy holders

- ReferralMD offers a price transparency tool for referring doctors and patients that lists every doctor in the country, which procedures they perform, how many patients received that treatment, and the average cost. Not only does it helps patients find better care, it offers tools to streamline referral communication between health facilities which reduces patient wait times by upwards of 80 percent by offering a priority work queue for care teams to manage their referrals.

- PokitDok is probably the option closest to being a universal solution as an API provider for the healthcare industry. With relationships to 500+ insurance companies, it provides access to real-time eligibility, claims data and referrals, scheduling, etc. It enables customers to find healthcare providers, do price comparisons and solicit quotes and explore optimal financing options. It’s touted by the Wall Street Journal as being able to, “get around a thorny issue in modern-day healthcare delivery, the interoperability of different electronic health records.” There’s that and that in 2015, it picked up $34 million in Series B funding.

- Castlight Mobile is another third party option available through some employee benefit plans to help find affordable and high quality care, anytime, anywhere. Also doubling as an insurance card, it helps customers find in-network providers and provides personalized cost estimates. It also enables tracking of deductibles, HSA balances and policy coverage.

No studies have been conducted yet, but it would be interesting to see how well these automated pricing systems stack up against the essentially handcrafted estimates of a healthcare provider like Baptist Health System’s.

Key Price Transparency System Components

These “best of category” applications are rich in features, particularly for being a “one stop shop” for almost everything related to shopping and even paying for healthcare. Mobile makes it far easier to do more than shop around for prices, so new solutions will have to do more to be competitive in the future. The following itemizes the components of what a complete healthcare price transparency solution should include:

- Provide healthcare facilities available by a user-defined geographical radius.

- Automatic collation of those facilities on user-defined treatment or procedure basis.

- Price of the medical procedure by each facility, on an in and out-of-network basis.

- A price comparison to emergency departments vs. urgent care facilities, etc.

- Determine if a medical procedure is covered by customer’s health insurance company.

- Ability to reference and track payments, deductibles and out-of-pocket maximums.

- Ability to conference with a medical or administrative representative for additional information.

- Serve as an insurance card and enable mobile payments.

- Ability to schedule appointments and enable electronic completion and/or transfer of forms.

- Ability to integrate with other mHealth and Telemedicine applications or features.

Competing on the Mobile Front

Healthcare providers and health insurance companies (broadly speaking) are the two most likely segments able to practically engage healthcare price transparency. Each, however, has their own positioning. It is a competitive measure for healthcare companies, a cost-savings interest for insurers. As the issue picks up steam, we can expect competition within the healthcare community to increase quite dramatically. Many providers are not well-prepared to compete gauging from the reaction some clinics had to aspects of UnitedHealthcare’s program, particularly in the State of Florida. The most attractive aspect associated with a mobile application is its potential to scale. Mobile apps inherently benefit from economies of scale. They also make achieving an economy of scale easier than almost any other model. The cost of developing an application, like with most software, is essentially the same whether it is distributed to one person or one hundred thousand people.

United Healthcare shows that it helps to have a pre-existing market. They already have customers with insurance policies. PokitDok and Castlight Mobile represent options for other insurers wanting a fast solution to offer their customers. referralMD offers MD’s and Dentists a better way to communicate with their referral network and offer a higher level of service to both their patients and referral sources.

One estimate puts the total number of mHealth insurance and financial related applications at about 5,000 of which roughly only 10% have found traction. Comparatively, about five hundred mobile games are submitted to the App Store almost daily, for what is a $100 billion market. These numbers alone indicate the healthcare market is seriously under utilizing mobile technology and that there’s ample opportunity for innovative companies to reap vast rewards.

Mobile is enabling a lot more than just price transparency.

Most Electronic Healthcare Systems emerging after The Paperwork Reduction Act of 1995 were based on the capabilities of desktop computers and peripherals. Mobile can streamline the administrative and paperwork requirements further. It enables for mobile triage and in the On-Demand segment, we’ve seen the rise of Q.care from Pediacare emerge in Texas. This empowers customers to have pediatricians and registered nurses to come directly to their home.

The healthcare industry may have concerns about being called before the Senate Finance Subcommittee on Health Care over healthcare prices. But, the real questions are going to come from customers and patients. Mobile technology will not be going away anytime soon, nor will customer’s financial concerns.

Conclusion:

It’s not an issue of what may need to be done in the future, but what some are already doing now. Given the choice between having your MRI done at one hospital for $700, or another hospital for $3,000, or one that will only tell you after it’s been done, which would you choose?

Somehow, it doesn’t look like a strategy based on evasive maneuvers will work very well, at least not for long.

Guest post by: Artem Petrov

Artem is a serial entrepreneur and the CEO at Reinvently, a mobile product agency from Palo Alto, CA. His background in applied mathematics and design spans 15 years of experience in building better businesses with mobile tech. Artem’s passion for user experience and data is the driving force behind making beautiful apps with exceptional business value.