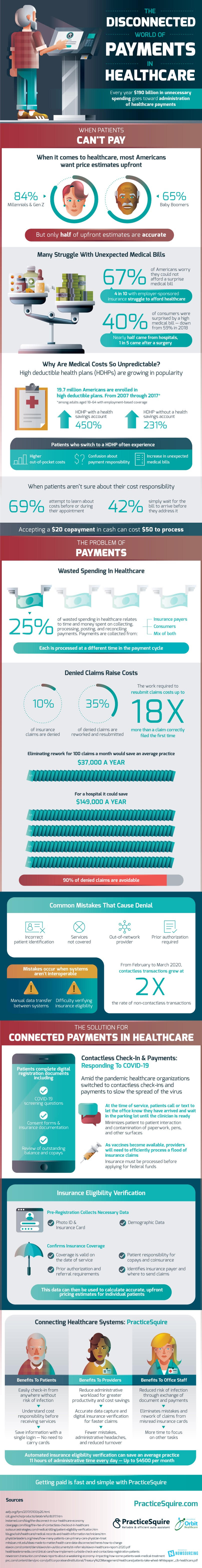

Beyond the complexity, every payment brings to the healthcare system, denied payments raise costs even further. 10% of insurance claims are typically denied. Of the denied claims, 35% are reworked and resubmitted, costing even more time and work for the healthcare providers. The work it takes to resubmit claims costs up to 18 times more than a claim filed correctly for the first time. 90% of denied claims are avoidable. The most common mistakes that cause insurance claims to get denied are incorrect patient information, request for services not covered by insurance, seeking care from an out-of-network provider, and needing prior authorization first. All of these causes are as frustrating as they are simple. If healthcare providers eliminated rework for as low as 100 claims a month, the average practice would save $37,000 a year. For a hospital, that total is even higher, at $149,000 a year.

While the pain felt by healthcare providers’ overpayment dysfunction is serious, the problem is even worse for patients. When it comes to healthcare, most Americans want price estimates upfront. That value stands at 84% for Millennial and Generation Z patients and 65% for Baby Boomers, a clear majority in both cases. Unfortunately, only half the upfront estimates patients receive are accurate. In many cases, the estimate is based on incomplete information and does not properly account for the type of insurance held by the patient. As a result of this lack of transparency, many struggles with unexpected medical bills. 67% of Americans worry they could not afford a surprise medical bill. That percentage stretches far beyond the uninsured; 4 in 10 of those with employer-sponsored healthcare insurance struggle to afford healthcare. The situation is all too common. In 2018, the percentage of consumers surprised by an expensive medical bill reached a high of 59%. Since then, it has fallen to 40%, which still means millions are affected each year. Nearly half of patients surprised by a high medical bill came from hospitals; for 1 in 5, this happened after surgery.

Why are medical costs so unpredictable? One reason is that high deductible health plans (HDHPs) are growing in popularity. Today, almost 20 million Americans are enrolled in a high deductible plan. From 2007 to 2017, HDHPs with a health savings account (HSA) grew 450% in usage. At the same time, HDHPs without an HSA grew by 231%. Despite their increasingly wide usage, HDHPs do present some drawbacks to their users. Patients who switch to a high deductible health plan often experience higher out-of-pocket costs, confusion about payment responsibility, and an increase in unexpected medical bills. When there is uncertainty about cost responsibility, 69% of patients attempt to learn about costs before or during their appointment, not always with success.

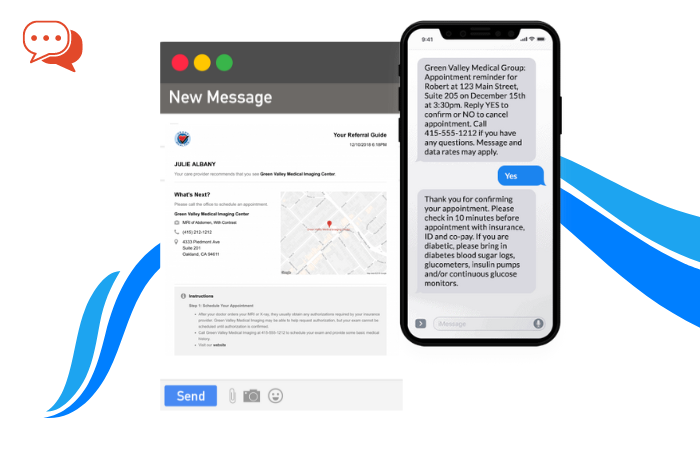

Does paying for healthcare have to be this confusing? Honestly, no. One rising solution for connected payments in healthcare is switching to contactless check-in and payments. A system originally devised in the wake of COVID-19, contactless check-in allows patients to call or text to let the office know they have arrived and lets them wait in the parking lot instead of the waiting room until their clinician is ready. Beyond the pandemic, this will help practices cut down on patient-to-patient interaction and contamination of paperwork, pens, and other surfaces for other contagious illnesses like the flu. As vaccines become more widely available, providers will need to efficiently process a flood of insurance claims, as insurance must be processed before applying for federal funds. Given the aforementioned confusion, providers have an incentive to streamline the process as much as possible.

How does contactless check-in help providers with insurance eligibility and payment information? First, pre-registration collects necessary data like photo ID, insurance card, and demographic data. Next, the check-in process can confirm insurance coverage is valid on the date of service. It can check for prior authorization, and referral requirements before services are rendered and determine patient responsibility for copays and coinsurance. Such data can be used to calculate accurate, upfront pricing estimates for individual patients. Patients benefit from easy check-in and a better understanding of cost responsibility. Providers reduce administrative workload for greater productivity and cost savings, allowing them to spend more time doing the job they’re meant to do. Regarding the office staff of practices and hospitals, they are at a reduced risk for infection. They don’t have to spend as much time eliminating mistakes and reworking claims due to misreading insurance cards. To put these benefits into numbers, automated insurance eligibility verification can save an average practice 11 hours of administrative time every day. That is up to $4500 per month or $54,000 annually. That may not account for all the wasteful spending in healthcare administration, but it certainly reduces the burden.

Solutions and technologies now exist to make this possible to make getting paid fast and simple, and their automated technology is there to benefit patients and providers alike. Through their network, patients complete digital registration documents, including COVID-19 screening questions, consent forms, and insurance documentation, and a review of outstanding balances and copays. This convenient service is available to patients in mobile form, increasing a patient’s convenience even further by removing the need for a desktop computer.